In an era where financial stability seems increasingly challenging to achieve, understanding and applying effective financial planning tips is more crucial than ever for millennials. The landscape of student loans, credit cards, and the competitive housing market demands a strategic approach to money management. A solid foundation in budgeting, debt management, and investing can not only improve a millennial’s current financial situation but also secure their future prosperity. This article highlights the importance of financial literacy and strategic planning in navigating the complexities of today’s economic environment.

The discussion will cover essential strategies such as creating a dedicated budget and sticking to it, building an emergency fund for unforeseen expenses, and the significance of paying off high-interest debt as quickly as possible. It will delve into the benefits of starting to invest early, taking advantage of compound interest, and maximizing retirement savings to ensure financial security in later years. The importance of establishing clear financial goals, protecting assets through comprehensive risk coverage, and planning for major life events cannot be overstated. Additionally, seeking professional financial advice for personalized strategies in asset allocation, income-driven repayment plans, and improving one’s credit score will also be explored. Through these financial planning tips, millennials can navigate the path to financial independence with confidence.

Create a Budget and Stick to It

Budget creation strategies involve setting clear financial goals and aligning the budget to respect income streams. Millennials are advised to allocate funds for essential expenses such as rent and groceries while reducing non-essential expenses like dining out [1].

Budget tracking tools are crucial for maintaining financial discipline. Using apps like Goodbudget, which employs a digital version of the envelope method, helps in categorizing and controlling spending effectively. This method ensures that once the allocated money in each digital envelope is spent, no further spending is allowed in that category until the next paycheck [2].

Budget adjustment techniques require regular reassessment to stay on track. It’s important to compare monthly income against expenses to identify potential savings or areas where spending can be reduced. Adjustments may include cutting back on ‘wants’ or re-evaluating ‘needs’ to better align with financial goals [3]. Regular reviews of the budget ensure that adjustments are made in time to meet changing financial circumstances or goals.

Build an Emergency Fund

Emergency Fund Importance

An emergency fund acts as a financial safety net, designed to cover unexpected costs such as medical bills, job loss, or urgent home repairs [4][5][6]. Experts stress the importance of having this fund to prevent debt accumulation during crises [7]. It’s essential not just for immediate relief but also for maintaining financial stability in the long run [4].

Emergency Fund Size Recommendations

The size of an emergency fund can vary based on individual circumstances, but the general recommendation is to save three to six months’ worth of living expenses [4][8][9]. For those with more volatile job situations or higher debt levels, aiming for up to a year’s worth of expenses might be advisable [4][9]. This ensures sufficient coverage for various financial setbacks without the need to incur debt [5][6].

Emergency Fund Savings Strategies

Building an emergency fund should be a gradual process, starting with achievable goals and increasing the savings amount over time [6]. Automating savings can simplify the process, ensuring regular contributions without requiring active management [5][7]. High-yield savings accounts or money market funds are recommended for storing these funds, as they provide better returns while keeping the money accessible [4][5].

Pay Off High-Interest Debt

Debt Prioritization Methods

One effective strategy for managing high-interest debt involves listing all credit card and loan accounts by their interest rates, prioritizing the highest rates first. This method ensures that the most costly debts are addressed early, reducing the overall interest paid over time [10].

Debt Repayment Strategies

The debt avalanche method is highly recommended for tackling debt efficiently. By focusing on the highest interest rate debts first and making minimum payments on others, individuals can significantly cut down the interest accumulation and expedite the debt-free process. Once the highest interest debt is cleared, the payments are then redirected to the next highest, creating a powerful cascade effect [11].

Debt Consolidation Options

A debt consolidation loan can simplify multiple debt repayments into one monthly payment, often with a lower interest rate. This not only makes managing payments easier but can also improve credit scores by reducing credit utilization and ensuring consistent, on-time payments. However, it’s crucial to avoid accruing additional debt during this period to fully benefit from consolidation [12].

By employing these methods, individuals can strategically reduce their debt burden, potentially saving significant amounts in interest and accelerating their journey towards financial freedom.

Start Investing Early

Investment Basics for Millennials

Millennials should recognize the long-term benefits of investing early. Historically, large capitalization stocks have delivered a compounded annual return of approximately 10% from 1926-2020, significantly outperforming both long-term government bonds and T-bills [13]. Starting investments in one’s mid-20s to mid-30s allows for the powerful effect of compounding, where even small amounts can grow substantially over decades [13].

Investment Vehicle Options

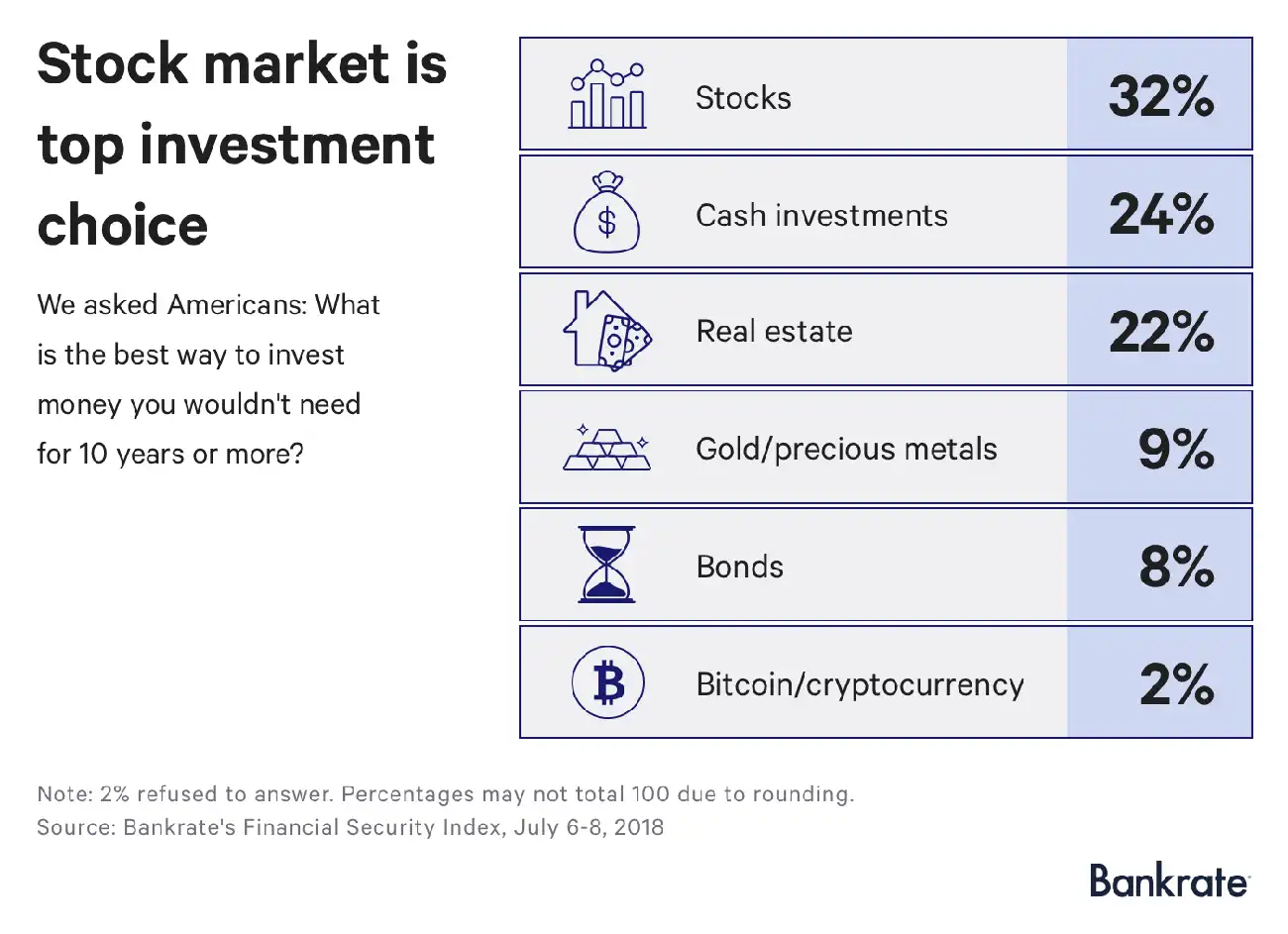

Millennials have a variety of investment vehicles at their disposal, including IRAs, 401(k)s, brokerage accounts, and more specialized options like Roth IRAs and ETFs. Each of these accounts has distinct advantages, such as tax benefits for IRAs and employer matching for 401(k)s. For example, contributing to a Roth IRA allows for tax-free withdrawals after age 59½ [13]. Meanwhile, ETFs offer a way to invest in a diversified portfolio with lower fees, making them an attractive option for those new to investing [13].

Investment Risk Management

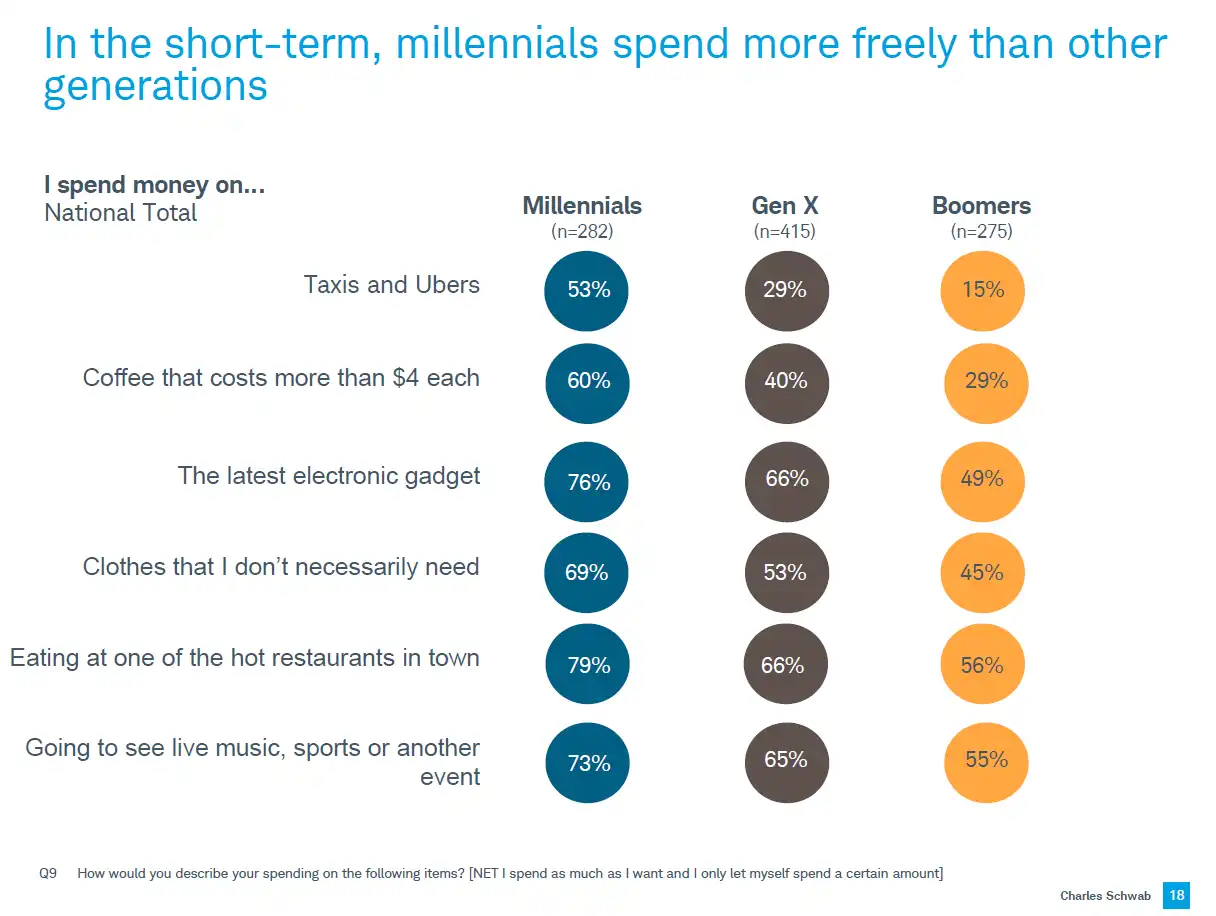

Understanding and managing investment risk is crucial. While millennials are known to engage in riskier investments like cryptocurrencies, a significant portion values a diversified portfolio to mitigate risks [14]. About 95% of Gen Z and millennial investors consider risk in their investment decisions, with a substantial number actively managing their risk exposure by diversifying across various asset types [14]. This strategic approach helps in balancing potential returns with acceptable levels of risk, ensuring a more stable financial future.

Maximize Retirement Savings

Retirement Account Types

Retirement savings accounts are essential for long-term financial security, and understanding the different types available is crucial. The most common are 401(k) plans and Individual Retirement Accounts (IRAs). 401(k)s, often matched by employers, allow pre-tax contributions which grow tax-deferred until withdrawal [15]. IRAs offer similar tax advantages but are available to anyone with earned income, making them an excellent option for the self-employed [15].

Retirement Savings Strategies

Maximizing retirement savings involves more than just understanding account types; effective strategies are crucial. One fundamental approach is starting early to take advantage of compound interest, significantly increasing the value of savings over time [16]. Additionally, contributing enough to receive full employer match in a 401(k) can effectively double the investment at no extra cost to the employee [16]. For those without access to employer-sponsored plans, contributing the maximum to an IRA is advisable [17].

Retirement Goal Setting

Setting clear, achievable retirement goals is vital for financial planning. These goals should be specific, measurable, achievable, results-focused, and time-sensitive (SMART). An example might be aiming to save $100,000 by age 30 [18]. It’s also recommended to plan for expenses in retirement to be at least 80% of pre-retirement income, ensuring a comfortable standard of living [17]. Understanding these goals and the steps to achieve them can significantly impact one’s financial security in later years.

Improve Financial Literacy

Financial Education Resources

To enhance financial literacy, millennials can access a broad range of educational resources. Subscribing to financial newsletters offers insights into current events and personal finance trends, while financial podcasts provide a convenient way to learn on-the-go [19]. For those who prefer reading, a plethora of books on personal finance are available, with topics ranging from budgeting to wealth building [19]. Social media platforms like YouTube and Facebook also serve as valuable tools for following financial experts and joining community discussions [19].

Key Financial Concepts

Understanding key financial concepts is crucial for effective money management. Financial literacy encompasses the knowledge of how money is earned, managed, and invested [20]. It includes mastering basic concepts such as saving, investing, and debt management, which are fundamental for making informed financial decisions and achieving economic well-being [20].

Ongoing Learning Strategies

Maintaining financial literacy requires continuous education. Regular updates through seminars, books, and online platforms ensure that individuals stay informed about the financial world’s complexities [20]. Engaging with financially literate communities and participating in financial literacy workshops can also enhance understanding and motivation [20]. Moreover, consulting with financial professionals provides tailored advice to navigate personal financial situations effectively [20].

Establish Clear Financial Goals

Short-term vs. Long-term Goals

Financial goals are generally categorized based on their expected completion time. Short-term goals are those anticipated to be achieved within a year, such as saving for a new appliance or paying off a small credit card balance. In contrast, long-term goals extend beyond five years and include objectives like retirement savings or funding a child’s education. The distinction is crucial as it influences the financial strategies employed; short-term goals typically require more liquid assets to allow quick access when needed [21].

Goal-setting Techniques

Effective financial goal setting involves clarity and a structured approach. Utilizing the SMART criteria—Specific, Measurable, Achievable, Relevant, and Time-bound—helps in setting clear objectives. For instance, instead of merely aiming to save money, a SMART goal would be to save $3,000 for an emergency fund within a year. This method not only provides a clear target but also includes a timeline and measurable outcome, making the goal more tangible and actionable [22].

Goal Tracking Methods

Keeping track of progress towards financial goals is essential for success. Writing down goals and reviewing them regularly can significantly enhance the likelihood of achieving them. This practice helps maintain focus and adjust strategies as needed. Additionally, using financial tracking tools can provide insights into spending patterns, helping identify areas where adjustments are necessary to stay on track towards financial objectives [23].

Protect Your Assets with Insurance

Types of Insurance for Millennials

Millennials face unique financial challenges and responsibilities, making appropriate insurance coverage essential. Options include health insurance, which can be accessed through a parent’s plan until age 26, student health plans, or the Marketplace during open enrollment periods [24][25]. Additionally, life insurance is crucial regardless of age, offering protection against unexpected costs and providing for dependents [26][27]. Disability insurance is also recommended to safeguard against income loss due to accidents [26].

Insurance Coverage Recommendations

When selecting insurance, the primary goal should be to secure adequate coverage that meets individual needs before considering cost [26][28]. This includes evaluating personal circumstances and potential risks to ensure comprehensive protection. For instance, life insurance should cover debts like student loans and provide for children’s future needs [27]. It’s also wise to consider additional coverage for specific valuable items or special circumstances [28].

Insurance Cost-Saving Tips

To reduce insurance costs, millennials should explore discounts and consider bundling policies, such as auto and renters insurance, to save money [26][28]. Paying policies in full or maintaining a good academic record can also lead to discounts. Additionally, consulting with independent insurance agents can provide access to a broader range of products and potentially better rates, as they can compare offerings from multiple carriers [26][28].

Plan for Major Life Events

Financial Planning for Marriage

Financial harmony is crucial for marital success, with money issues being a leading cause of divorce [29]. Couples are encouraged to engage in open discussions about finances before marriage, establishing a financial checklist that promotes transparency and trust. This includes disclosing assets, liabilities, and financial expectations [29]. Effective communication about money can lead to compromise and a healthier relationship, reducing the likelihood of conflicts [29].

Saving for a Home Purchase

For many, homeownership is a significant financial goal. Preparing for a home purchase involves assessing one’s financial situation, saving for a down payment, and understanding mortgage requirements [30]. Young adults should consider the impact of mortgage costs, property taxes, and the potential need for private mortgage insurance (PMI) [30]. Building a strong credit history and increasing income are essential steps to meet lender thresholds and manage the true cost of homeownership [30].

Preparing for Parenthood

Parenthood requires substantial financial preparation. Prospective parents should discuss and align their financial goals, considering the costs of raising a child, including education, healthcare, and daily living expenses [31]. It is crucial for couples to take concrete actions to secure their financial future, such as setting up savings plans and exploring life insurance options, to support their family effectively [31].

Seek Professional Financial Advice

When to Consult a Financial Advisor

Individuals should consider seeking professional financial advice when unsure about managing finances or investments. It is particularly crucial when approaching major life events like retirement, buying a home, or starting a family. Those with complex financial situations, such as multiple income streams, significant assets, or a need for tax planning, would also benefit significantly from consulting a financial advisor [32].

Choosing a Financial Advisor

Selecting the right financial advisor involves looking for a fiduciary advisor who is legally required to act in the client’s best interest. It’s essential to consider the advisor’s qualifications, experience, and areas of expertise. Transparency in fees and compensation structure is crucial, along with an understanding of the advisor’s investment philosophy and approach. The advisor’s communication style and personality should also be a good fit for the client [32].

Cost of Financial Advice

The fees for financial advice can vary widely based on the advisor’s services and the complexity of the client’s financial situation. Common fee structures include hourly rates, flat fees, or a percentage of assets under management. Understanding these costs upfront and how they integrate into the overall financial plan is vital for maintaining a balanced budget and achieving financial goals [32].

Conclusion

Through this comprehensive discussion, it becomes evident that the road to financial independence for millennials is paved with diligent planning, well-informed decisions, and strategic actions across various facets of personal finance. From crafting and adhering to a rigorous budget to building a robust emergency fund, prioritizing debt repayment, and investing wisely from an early stage, the principles laid out offer a blueprint for not only navigating but thriving in today’s economic landscape. Moreover, the importance of safeguarding one’s future through proper insurance, setting realistic financial goals, preparing for life’s significant milestones, and seeking expert advice encapsulates a holistic approach towards achieving financial stability and growth.

As millennials continue to face unique challenges and opportunities within the financial domain, adhering to these guidelines can significantly enhance their ability to build a secure and prosperous future. Embracing a culture of lifelong learning, openness to professional guidance, and a commitment to financial literacy further empower individuals to make sound financial decisions. Ultimately, the journey towards financial enlightenment and independence is both rewarding and essential, offering profound implications for personal fulfillment and societal well-being. This narrative not only closes the chapter on effective financial planning for millennials but also opens the door to a future replete with potential and promise.

FAQs

What does the 50/30/20 budgeting rule entail?

The 50/30/20 budgeting rule suggests allocating 50% of your income to essential needs, 30% to discretionary wants, and the remaining 20% to savings and future financial goals.

Can you outline the 10 fundamental steps in financial planning for beginners?

Certainly! The top 10 foundational steps in financial planning include: managing your money effectively, regulating your expenses wisely, maintaining a personal balance sheet, judiciously handling surplus cash, creating a personal investment portfolio, planning for retirement, managing debts wisely, getting adequate risk coverage, and more as outlined by ClearTax.

What are the seven critical areas to include in a financial plan?

Every comprehensive financial plan should cover these seven key areas: budgeting, investment planning, tax planning, education planning, retirement planning, estate planning, and insurance planning.

What are the seven essential components of financial planning?

The seven crucial components that make up a solid financial plan include: setting business goals and objectives, budgeting and financial forecasting, managing cash flow, planning for capital expenditures, strategizing debt and financing, analyzing profitability, and implementing risk management and contingency planning.

References

[1] – https://www.koho.ca/learn/budgeting-for-millennials/

[2] – https://www.cnbc.com/select/money-apps-for-college-students/

[3] – https://bettermoneyhabits.bankofamerica.com/en/saving-budgeting/creating-a-budget

[4] – https://finance.yahoo.com/news/m-financial-expert-much-money-130751857.html

[5] – https://www.wellbyfinancial.com/blog/emergency-savings-smart-guide/

[6] – https://www.securian.com/insights-tools/articles/5-steps-to-building-an-emergency-fund.html

[7] – https://www.consumerfinance.gov/an-essential-guide-to-building-an-emergency-fund/

[8] – https://www.cnbc.com/2023/11/14/cfp-first-step-gen-z-should-take-to-build-an-emergency-fund.html

[9] – https://www.cnet.com/personal-finance/banking/advice/heres-how-much-you-should-have-in-your-emergency-fund-according-to-experts/

[10] – https://www.experian.com/blogs/ask-experian/best-ways-for-millennials-to-pay-off-debt/

[11] – https://www.principal.com/individuals/build-your-knowledge/3-ways-pay-your-debt

[12] – https://www.experian.com/loans/debt-consolidation/

[13] – https://www.bankrate.com/investing/millennial-guide-to-investing/

[14] – https://www.fool.com/research/gen-z-millennial-investors-risk/

[15] – https://www.equifax.com/personal/education/life-stages/articles/-/learn/types-of-retirement-accounts/

[16] – https://smartasset.com/retirement/best-retirement-plans-for-young-adults

[17] – https://www.investopedia.com/articles/financial-advisors/122815/how-much-millennials-should-save-retire-comfortably.asp

[18] – https://www.westernsouthern.com/retirement/how-to-set-retirement-goals

[19] – https://www.athene.com/smart-strategies/6-ways-to-improve-your-financial-literacy.html

[20] – https://www.nasdaq.com/articles/financial-literacy-basics-concepts-strategies-and-challenges

[21] – https://www.citizensbank.com/learning/planning-for-short-term-and-long-term-goals.aspx

[22] – https://www.achieveit.com/resources/blog/7-effective-goal-setting-techniques/

[23] – https://www.forbes.com/sites/melissahouston/2024/01/12/how-to-track-your-spending-and-slay-your-finances/

[24] – https://www.healthcare.gov/young-adults/

[25] – https://www.healthcare.gov/blog/health-coverage-for-young-adults

[26] – https://www.grangeinsurance.com/tips/insurance-tips-millenials

[27] – https://www.marketwatch.com/guides/life-insurance/life-insurance-considerations-for-millennials/

[28] – https://www.palmettoinsurance.com/blog/5-insurance-tips-for-millenials

[29] – https://www.cnb.com/personal-banking/insights/wedding-financial-checklist.html

[30] – https://www.titan.com/articles/how-to-start-saving-for-a-house-in-your-20s

[31] – https://hackyourwealth.com/family-finances

[32] – https://www.marketwatch.com/picks/are-you-still-paying-1-to-your-financial-adviser-heres-what-might-make-a-lot-more-sense-and-save-you-tens-of-thousands-of-dollars-01659470645